Temporary Mortgage Buydowns

Offering 3-2-1, 2-1, 1-1, and 1-0 temporary mortgage buydowns.

Lock in Today's Rates for Tomorrow's Savings: Enjoy a Temporary Mortgage Buydown Now!

A mortgage buydown is a financing technique where a borrower pays an upfront fee to the lender in exchange for a reduced interest rate on the mortgage loan. The buydown can be temporary or permanent, depending on the terms of the agreement. Keller Home Loans is pleased to offer a variety of temporary buydown programs to borrowers looking to lower their monthly payments or increase their purchasing power.

Contact Me

How does a temporary mortgage buydown work?

A temporary mortgage rate buydown involves the borrower making an upfront payment to the lender at closing. This payment is then utilized to lower the interest rate on the mortgage loan for a specific time, which typically ranges from one to three years. This reduced interest rate translates to lower monthly mortgage payments for the borrower throughout the buydown period. Once the buydown period concludes, the interest rate and monthly payments will revert to the original terms agreed upon in the loan contract.

3-2-1 Buydown

The 3-2-1 Temporary Buydown reduces the buyer’s interest rate by 3% for the first year of their loan, 2% for the second year, and 1% for the third year.

EXAMPLE: Sale price: $400,000 | Down payment: $80,000 | Loan amount: $320,000 | 30-year fixed rate: 7.50% |

APR 7.724%| P&I payment $2,796.86 | 360 monthly payments | Payment stated does not include taxes and insurance.

Actual payment obligations may be greater and may vary.

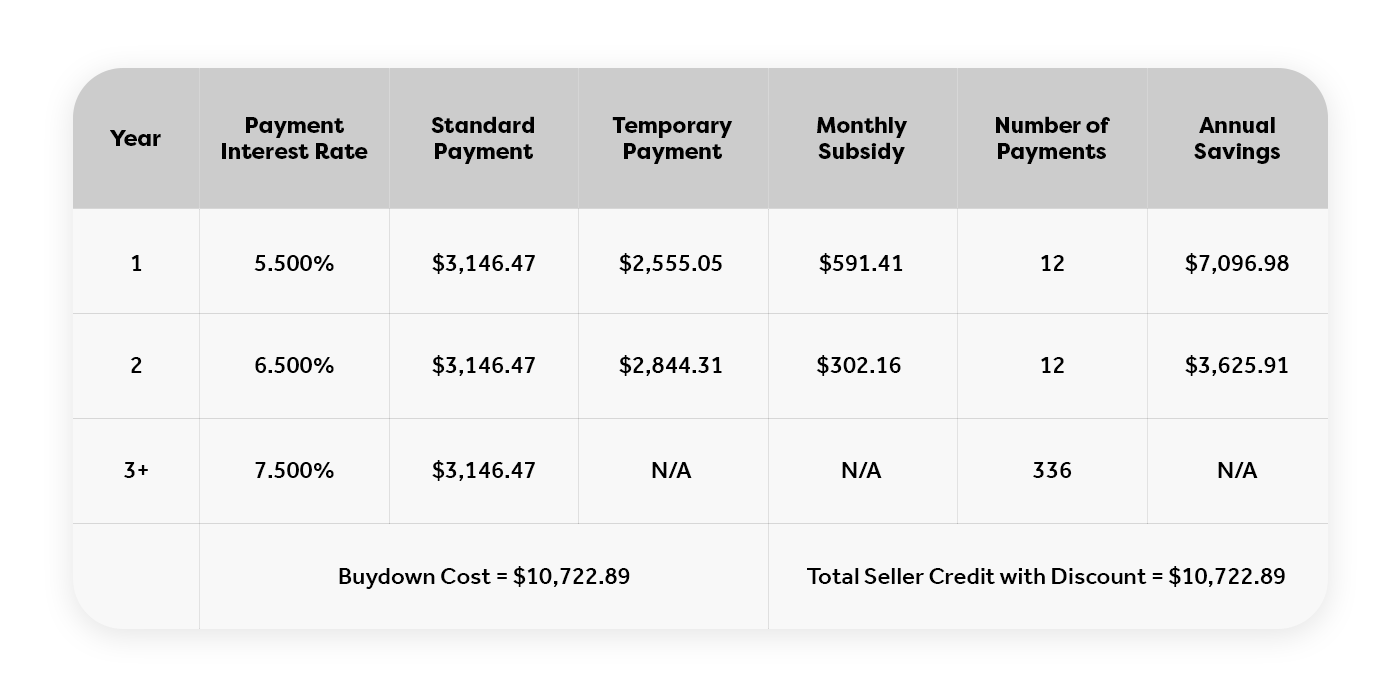

2-1 Buydown

The 2-1 Buydown is another type of temporary buydown program that offers a payment based on an interest rate 2% lower for the first year of the loan and 1% for the second year. This program is similar to the 3-2-1 buydown but offers a shorter period of reduced interest rates.

EXAMPLE: Sale price: $450,000 | Down payment: $90,000 | Loan amount: $360,000 | 30-year fixed rate: 7.50% |

APR 7.724%| P&I payment $3,146.47 | 360 monthly payments | Payment stated does not include taxes and insurance.

Actual payment obligations may be greater and may vary.

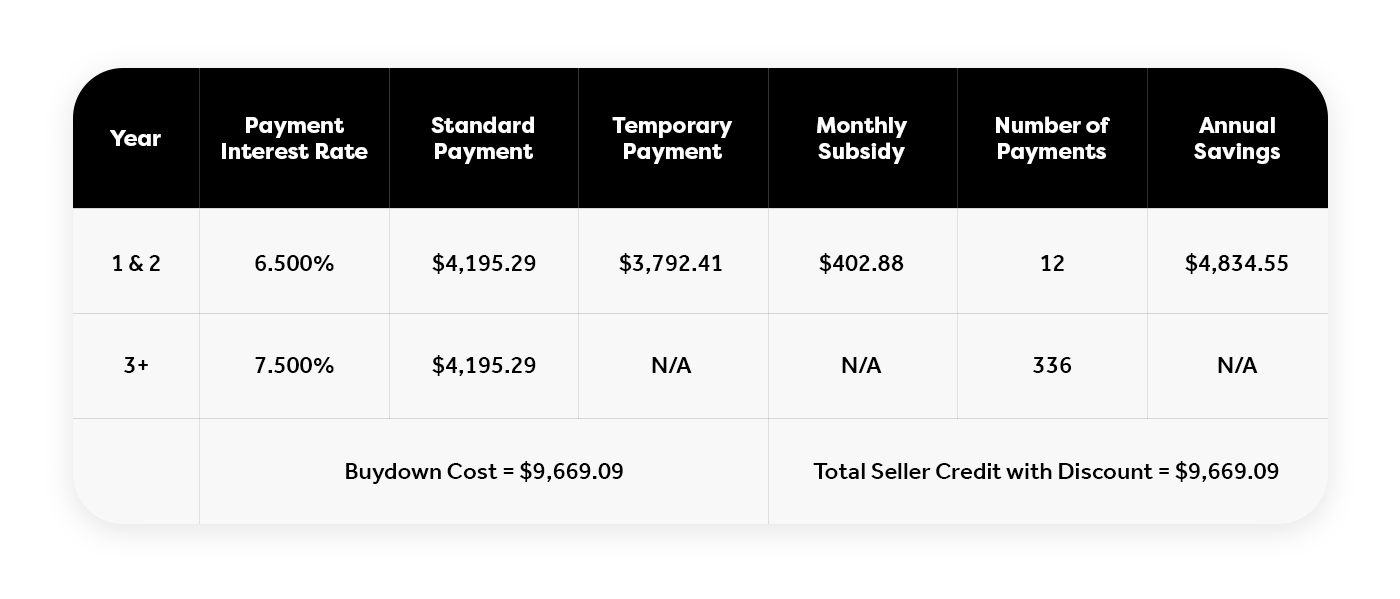

1-1 Buydown

The 1-1 Buydown is a temporary buydown program that offers a payment based on an interest rate 1% lower for the first two years of the loan. This program is designed to help borrowers save on monthly payments during the initial years of the loan.

EXAMPLE: Sale price: $600,000 | Down payment: $120,000 | Loan amount: $480,000 | 30-year fixed rate: 7.50% |

APR 7.717 | P&I payment $4,195.29 | 360 monthly payments | Payment stated does not include taxes and insurance.

Actual payment obligations may be greater and may vary.

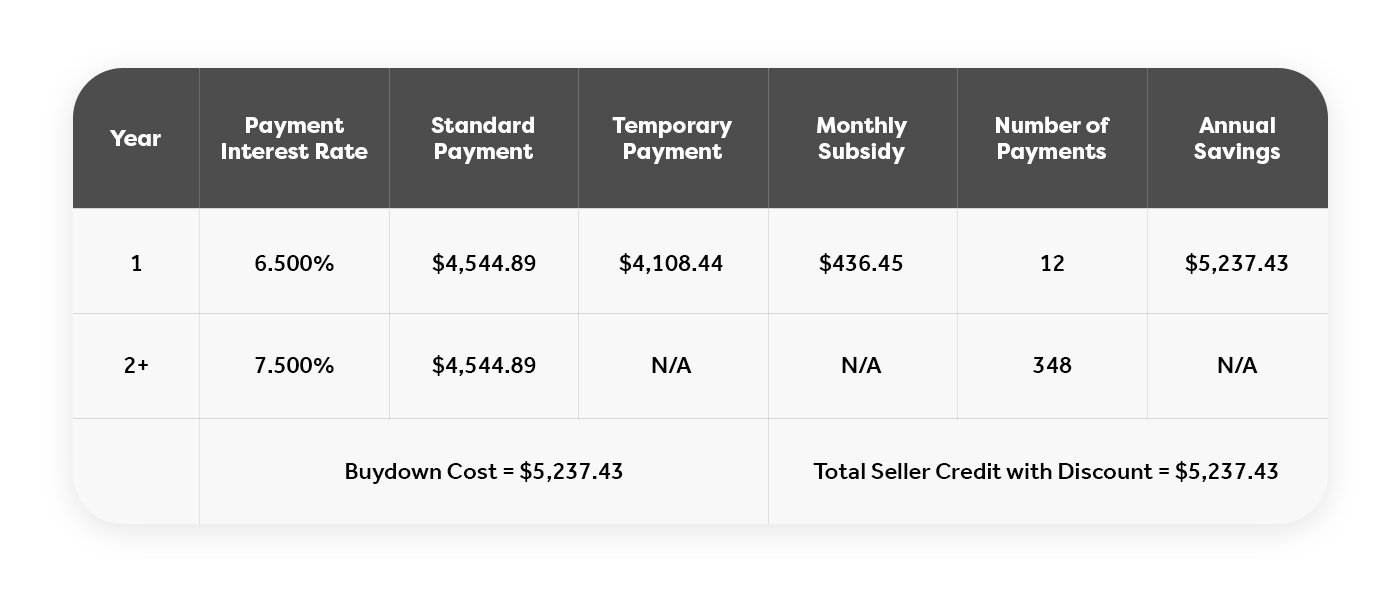

1-0 Buydown

The 1-0 Buydown is a temporary buydown program that offers a payment based on an interest rate 1% lower for the first year of the loan. This program is a simple version of the temporary buydown and is designed to reduce monthly payments during the first year of the loan.

EXAMPLE: Sale price: $650,000 | Down payment: $130,000 | Loan amount: $520,000 | 30-year fixed rate: 7.50% |

APR 7.716 | P&I payment $4,195.29 | 360 monthly payments | Payment stated does not include taxes and insurance.

Actual payment obligations may be greater and may vary.

Results are hypothetical and may not be accurate. This is not a commitment to lend or extend credit. The sample rates provided are for illustration purposes only and are not intended to provide mortgage or other financial advice specific to the circumstances of any individual and should not be relied upon in that regard. The payment example does not include assessments. Actual payment obligations may be greater and may vary. All loans are subject to credit approval. Rates and terms effective as of 12/12/2023 and subject to change. APR may vary. Not all borrowers qualify for all programs, must meet underwriting guidelines and are subject to credit review and approval. For mortgage loans other than fixed loans, it is possible that the borrower’s payment may increase substantially after consummation. The disclosed fees are estimates. Actual closing costs and the portion paid by Seller may vary. The information contained is subject to change without notice. Consult a financial professional for full details.

Why choose

Keller Home Loans?